Money is one of the biggest causes of divorce and conflict within marriage. It is also an area that Mitch and I knew would take some... practice. We knew this even when we were dating.

According to the financial guru Dave Ramsey, Mitch is a free spirit and I am a nerd when it comes to our finances.

This does not mean that Mitch doesn’t care. In fact, he cares a lot. The difference is attention span and interest level. Mitch cares because he wants us to be financially secure.

Quick tangent - Mitch is so sexy when he gets excited about getting out of debt and our financial future! I admire how he is leading us in such a positive direction.

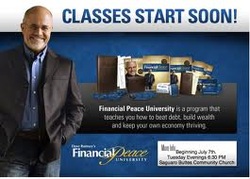

Mitch has about a 20-minute window of focus for money matters. I, on the other hand, can crunch numbers and talk for hours about financial plans. When we first completed the “Relating with Money” session of Dave Ramsey’s financial peace university where he talks about nerds and free spirits, we laughed a lot because we felt like he had spied in on our budgeting sessions. I was blushing the whole time, embarrassed by my nerd-hood. (Yes, I did make that word up...)

Even though we started out feeling good and laughing a lot, this journey toward financial peace has been hard. Many times, we find ourselves crying and facing down tough decisions. We decided not to buy a house this year. Our budget is tight since we are scrapping up money for dental bills and paying off the car. Nevertheless, we do have some exciting news:

WE PAID OFF OUR STUDENT LOANS!

How much did Mitch still have in student loans? $19,994.00. Normally, we would not have been able to do this so fast. It would have taken a couple years, except my grandma blessed us years ago with some inheritance in a couple of different ways. Not a lot, but enough to get us a solid start. I added money to it in college and we let the compounding interest do its thing. As a result, we used a good chunk of that to pay off the student loans.

What is our next step?

1. Pay off the car.

2. Build our 3-6 month emergency fund.

3. Begin saving for a down payment on a house.

4. Investing.

We will never be rich, but we can be secure. God is good and we are striving to live in a way that blesses His kingdom through our giving and stewardship of money.

Challenge:

Take a serious look at your financial situation with your spouse. Pray and seek guidance in your finances. Don’t let Satan turn you against each other over money. You are on the same team.

If you find that you are not where you would like to be, check out the Financial Peace University. You will not regret it!

According to the financial guru Dave Ramsey, Mitch is a free spirit and I am a nerd when it comes to our finances.

This does not mean that Mitch doesn’t care. In fact, he cares a lot. The difference is attention span and interest level. Mitch cares because he wants us to be financially secure.

Quick tangent - Mitch is so sexy when he gets excited about getting out of debt and our financial future! I admire how he is leading us in such a positive direction.

Mitch has about a 20-minute window of focus for money matters. I, on the other hand, can crunch numbers and talk for hours about financial plans. When we first completed the “Relating with Money” session of Dave Ramsey’s financial peace university where he talks about nerds and free spirits, we laughed a lot because we felt like he had spied in on our budgeting sessions. I was blushing the whole time, embarrassed by my nerd-hood. (Yes, I did make that word up...)

Even though we started out feeling good and laughing a lot, this journey toward financial peace has been hard. Many times, we find ourselves crying and facing down tough decisions. We decided not to buy a house this year. Our budget is tight since we are scrapping up money for dental bills and paying off the car. Nevertheless, we do have some exciting news:

WE PAID OFF OUR STUDENT LOANS!

How much did Mitch still have in student loans? $19,994.00. Normally, we would not have been able to do this so fast. It would have taken a couple years, except my grandma blessed us years ago with some inheritance in a couple of different ways. Not a lot, but enough to get us a solid start. I added money to it in college and we let the compounding interest do its thing. As a result, we used a good chunk of that to pay off the student loans.

What is our next step?

1. Pay off the car.

2. Build our 3-6 month emergency fund.

3. Begin saving for a down payment on a house.

4. Investing.

We will never be rich, but we can be secure. God is good and we are striving to live in a way that blesses His kingdom through our giving and stewardship of money.

Challenge:

Take a serious look at your financial situation with your spouse. Pray and seek guidance in your finances. Don’t let Satan turn you against each other over money. You are on the same team.

If you find that you are not where you would like to be, check out the Financial Peace University. You will not regret it!

RSS Feed

RSS Feed